January 29, 2026

Committed Gateway Pricing: A Rising Tide that Shares Merger Benefits

Committed Gateway Pricing (CGP) is an important element of our plan to share the merger’s pro-competitive benefits – including its downward pressure on costs – with thousands of customer locations and short lines who otherwise may not directly benefit. This pre-defined rate will enable CSX or BNSF to provide its customers a confidential, single thru-rate price on interline moves. But to understand CGP’s twin benefits, it’s important to first understand the overall context of the merger itself.

American businesses are the most competitive in the world. They rely on a highly efficient, reliable supply chain to deliver materials and move their products to market. Yet today, businesses who ship cross-country endure a drag on competitiveness whenever their freight crosses the artificial barrier that divides our country’s rail network into East and West. This mid-continent handoff between railroads adds time, cost and risk.

By creating America’s first transcontinental railroad, Union Pacific and Norfolk Southern will solve this decades-old problem. A fully connected rail system will create seamless single-line service on thousands of cross-country routes – reducing touch points, removing barriers and reaching underserved markets.

In our application to the Surface Transportation Board (STB), independent experts from leading industry advisor Oliver Wyman describe in compelling detail the three main customer advantages of single-line service: lower cost, faster delivery and greater reliability. These benefits are game changers that will make railroads more competitive with long-haul trucking and reinvigorate growth in America’s railroad industry.

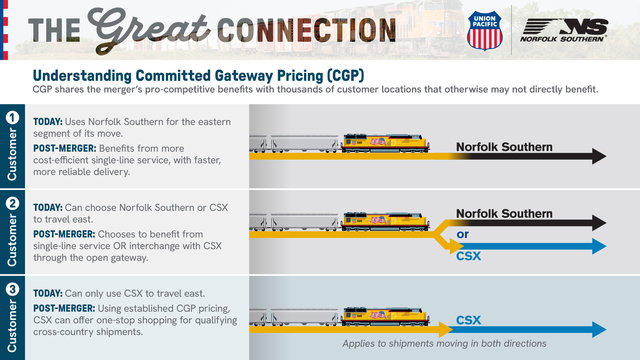

To understand how the merger is naturally pro-competitive, it’s helpful to think about three types of customers shipping coast-to-coast by rail.

The first type of customer uses Union Pacific for the western part of their move and Norfolk Southern for the eastern segment. After the merger, these customers will benefit from more cost-efficient single-line service, enjoying faster, more reliable delivery. The benefit is direct and clear.

The second type of customer uses Union Pacific in the west and has a choice of Norfolk Southern or CSX in the east. These customers will be able to choose the new seamless single-line service or interchange and complete their shipment using CSX. We will enable this by keeping gateways open on commercially reasonable terms, voluntarily using the same model the STB imposed in the Canadian Pacific-Kansas City Southern merger. The pro-competitive benefit for these customers is also very clear.

The third type of customer uses Union Pacific (or BNSF) in the west and can only use CSX (or Norfolk Southern) for the eastern part of their move. This freight will still need to change railroads, so the customer will not naturally benefit from single-line service. This also would apply to similar situations with short line railroads.

As our teams worked on the finer points of creating a transcontinental railroad, we recognized we could extend a portion of the merger’s benefits to this third type of customer through CGP – it’s our version of a rising tide that lifts all boats. CGP adds another competitive service option without taking away existing thru-rate or Rule 11 options.

CGP is a set of guaranteed rates for qualifying cross-country shipments that use the combined Union Pacific-Norfolk Southern railroad for a portion of the service and move through one of the major interchanges in Chicago, St. Louis, Memphis or New Orleans to either CSX or BNSF. The rates will be calculated based on our pricing per car-mile for similar shipments over the previous year, considering the type of freight being moved and the distance it travels on our network.

The rates will be offered for 23 categories of freight, such as agricultural and industrial products, but there are exceptions for shipments that require special handling or approvals (i.e. hazardous materials). Other types of freight – like intermodal and finished automobiles – are exempted because shippers have other competitive options for moving their products.

Here’s what makes CGP such a powerful enhancement of competition: Our eastern or western competitors can identify an opportunity to provide transcontinental service using a portion of our merged network. They might have forged a good relationship with a customer, created a strong service plan or identified a new market opportunity. Using the established CGP pricing – which will reflect the efficiency benefits of the merger’s single-line service – CSX or BNSF can move quickly to offer one-stop shopping and a single confidential rate without involving us in advance.

Beyond speed and simplicity, CGP’s real power lies in its pricing structure. Its pre-defined rate is informed by both the interline moves that will transform into single-line service post-merger and rates where facilities already benefit from competitive rail options. This approach will extend the merger’s downward pressure on costs to more customers, allowing them to benefit from efficiencies and competition they wouldn’t otherwise access.

The result is a rising tide that spreads the merger’s economic benefits more broadly across customers and the U.S. rail network – making a strongly pro-competitive end-to-end merger even more compelling. Everybody wins: Customers get a better experience at a better cost. We carry part of the shipment as those qualifying lanes grow. And our eastern and western competitors have a stronger service product to compete with long-haul trucking.

For more detailed information on our plans to offer CGP, I encourage you to read Katherine Novak’s verified statement (Volume 1, page 312) in our merger application. Visit AmericasGreatConnection.com to learn all the facts about the Union Pacific-Norfolk Southern combination.